July 11, 2022 7:16:28

The U.S dollar continues to reign its supremacy against all majors, specifically Yen on Monday while extending the previous week’s gains. Investors assessed the impact of the Bank of Japan (BoJ) policy passivity and the unfortunate assassination of former Prime Minister Shinzo Abe.

Japan’s ruling conservative coalition boosted its majority in the upper house election on Sunday. Mr. Abe was widely considered a key figure in the ruling party and held a prominent position in reviving the Japanese economy. The Bank of Japan (BoJ) remained the only major central bank among developed economies to hold an ultra-easy monetary policy.

The divergent monetary policy between US-Japan and global recession fears continued to favor the rampant rise of the USD. The U.S dollar index (DXY) touched the high of 137.28 as the fresh trading week begins, its highest since 2002.

Furthermore, the risk-averse mood amid the global growth outlook and high inflationary fears push capital flows to safe-havens. The dollar could enjoy the limelight until the risks around European energy concerns, elevated worldwide inflation pressures, and China’s growth outlook stabilized.

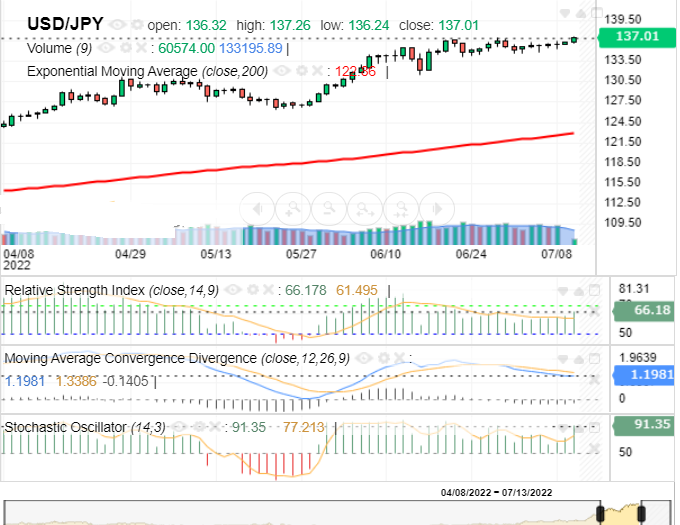

USD/JPY soars above 137.00

USD/JPY once again overstepped the 137.00 territories last seen in June as the pair remains optimistic on all time-frames. After a short-term consolidation in the previous week in the tight range of 134.90-136.00, the spot opened the new trading week with strong gains.

On the hourly chart, the price is well placed above the 20-day EMA (Exponential Moving Average). However, the pair retrace on a minor corrective pullback and is on the way to testing the mentioned average at 136.60.

A break below the 20-day EMA could convince bears to further testify to the 61.8% (Fib level).

Alternatively, a daily acceptance above 137.20 would result in the continuation of the upside momentum in USD/JPY.

Although Moneta Markets aims to ensure that the information/material is accurate, it cannot be held responsible for any omissions/miscalculations or mistakes as it does not warrant the accuracy of such material. Any material and/or content provided herein is intended for educational purposes only and does not constitute investment advice on how clients should trade as it does not take into consideration your personal objectives, financial circumstances or needs. Please seek independent advice before making any trading decisions. Reliance on such material is solely at your own risk and Moneta Markets cannot be held responsible for any losses resulting directly or indirectly from such reliance. Any reference to figures/statistics or numbers refers to the group of companies of Moneta Markets. Please refer to the legeal documents should you require more information.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, Cyprus, France, Spain, the United States, or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets (Pty) Ltd, an authorised Financial Service Provider (“FSP”) registered and regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa. Company Registration Number: 2016 / 063801 / 07. Contact Phone Number: +27 (10) 1429139. Operational Office: Unit 7, 31 First Avenue East, Parktown North, Gauteng, Johannesburg, 2193, South Africa.

Mmonexia Ltd, facilitates payment services to the licensed and regulated entities within the Moneta Markets Organizational structure.

Mmonexia Ltd registered in the Republic of Cyprus with registration number HE436544 and registered address at Archbishop Makarios III, 160, Floor 1, 3026, Limassol, Cyprus. Mmonexia Ltd, facilitates payment services to the licensed and regulated entities within the Moneta Markets Organizational structure.

Moneta Markets Limited. Business Registration Number:72493069. Registration Address: Flat/RM A 12/F ZJ 300, 300 Lockhart Road, Wan Chai, Hong Kong. Contact Phone Number: +852 37522556. Operational Office: Unit 1201, 12/F, FWD Financial Centre, 308 Des Voeux Road Central, Sheung Wan, Hong Kong.

Moneta Markets is a trading name of Moneta Markets (Pty) Ltd, an authorised Financial Service Provider (“FSP”) registered and regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa. Company Registration Number: 2016 / 063801 / 07. Contact Phone Number: +27 (10) 1429139. Operational Office: 31 First Avenue East, Parktown North, Gauteng, Johannesburg, 2193, South Africa.

Moneta Markets is a trading name of Moneta Markets Ltd, registered under Saint Lucia Registry of International Business Companies with registration number 2023-00068.

Mmonexia Ltd, facilitates payment services to the licensed and regulated entities within the Moneta Markets Organizational structure.